Fraud Scams

Criminals use clever schemes to defraud millions of people every year. They often combine sophisticated technology with age-old tricks to get people to send money or give out personal information. This could be by phone call, email, regular mail, texts or social media. They add new twists to old schemes and pressure people to make important decisions on the spot. One thing that never changes: they follow the headlines — and the money.

There are several ways these criminals go after your information and your money. The Department of Revenue (DOR) is committed to helping our citizens fight this ever increasing criminal activity. We have created this information page to help you determine if someone who is posing as a DOR employee either in person or by phone is legitimate. As new schemes and scams appear, we will continue to update this page with the most current scams facing our citizens.

Phone Scams

A phone scam is one way to target taxpayers. Callers will claim to be employees of the DOR, but are not. These criminals can sound convincing when they call. They use fake names and bogus DOR identification numbers. They may know a lot about their targets, and they usually alter the caller ID to make it difficult to know where the number originated.

Victims are told they owe money to the DOR and it must be paid promptly through a pre-loaded debit card or wire transfer. If the victim refuses to cooperate, they are then threatened with arrest or suspension of a business or driver’s license. In many cases, the caller becomes hostile and insulting.

Or, victims may be told they have a refund due to try to trick them into sharing private information.

Note that the DOR should never:

- Call you to demand immediate payment. We will not call about taxes you owe without first mailing you an assessment notice. The DOR may call to let you know that a return or payment is overdue, but they will instruct you to make a payment in your usual manner. A DOR employee will be able to reference the Letter ID number found in the upper left hand corner of the assessment notice.

- Demand that you pay taxes without giving you the chance to question or appeal the amount the caller says you owe. With all DOR assessments, you have the right to appeal within a certain time frame. The appeal process is explained on every assessment notice sent to the taxpayer.

- Require you to use a prepaid debit card as your payment method. The DOR allows many different methods of payment and does not require any specific one.

- Ask for credit or debit card numbers over the phone. If you pay by credit or debit card, you are the only one who enters card information. The DOR policy is for our employees to never ask for someone’s number or touch their card. If a DOR employee visits your place of business or your home, they do have the means for you to swipe your card or enter your number to pay a balance due, but swiping the card or entering the card number will never be done by a DOR employee.

If you get a phone call from someone claiming to be from the DOR threatening you and asking for money, here’s what to do:

- If you know you owe taxes or think you might owe, call the DOR District Office closest to you or the Revenue Officer in charge of your account to talk about payment options. You also may be able to set up a payment plan online at www.dor.ms.gov.

- If you know you don’t owe taxes or have no reason to believe that you do, report the incident to the DOR either by calling or going online and reporting it on our Tax Fraud Referral Form.

Letter Scams

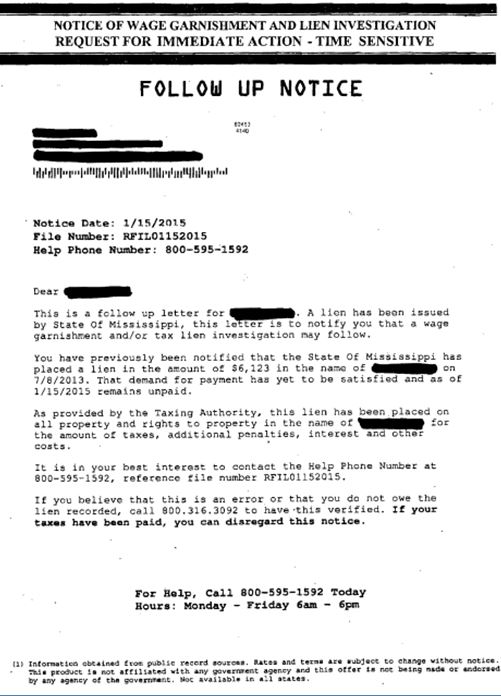

Taxpayers also receive mail concerning other financial matters. An example of a Letter Scam is shown here.

This type of letter is meant to intimidate taxpayers and to put money in the pocket of the people that sent the letter. There is enough information that it looks credible; however, this specific letter is incorrect. There is no current outstanding balance and there is no current tax lien against the name mentioned. (The name has been redacted to protect the individual.) The file and phone numbers do not belong to the DOR.

There are many other types of mailings that are sent out to our citizens requ requesting information or action to clear up supposed debt. The DOR will always have our name on documents issued by us. At any time, a taxpayer can call any District Office or our Call Center and find out the balance on their account. Taxpayer’s may also review the status of their account through their Taxpayer Access Point (TAP) account located on DOR’s website. Any balance due can also be discussed with the Revenue Officer in charge of your account.

Identity Theft Scams

The DOR warns about the fraudulent use of the DOR name or logo by criminals trying to gain access to your financial information in order to steal your identity and assets. Criminals will use the regular mail, telephone, fax or email to set up their victims. When identity theft takes place over the Internet (email), it is called phishing.

The DOR does use the Internet (email) to contact taxpayers. However, the email will only inform you of new information that is available on your Taxpayer Access Point (TAP) account. The DOR email will not ask you for any information. In fact, you are not to respond to any email from the DOR. Any DOR email will only inform you of new information concerning your account and request that you go to your secure TAP account and read the new information.

Additionally, clicking on attachments to or links within an unsolicited email claiming to come from the DOR may download a malicious computer virus onto your computer.

Reporting Tax-Related Schemes, Scams, Identity Theft and Fraud

To report the various types of tax-related illegal activities or scams, refer to our Tax Fraud Referral Form found on our website at www.dor.ms.gov on the right hand side under the “I want to…Report Tax Fraud”. Complete this form explaining what type of scheme, theft or fraud you think has occurred.

The DOR wants to help our citizens to identify these scams and protect themselves from these criminals.

Remember, the DOR currently does not use unsolicited email, text messages or any social media to discuss your personal tax issues.

You can always contact us to determine if someone is an employee of the DOR and if any information you are given is correct. You can find the correct number on our main webpage. Look under the Contact Us link on the left side of our webpage. Click on that and then scroll down to find the District Office closest to you.